|

Customer Support

219-756-3502

Toll Free - 800-987-1920 |

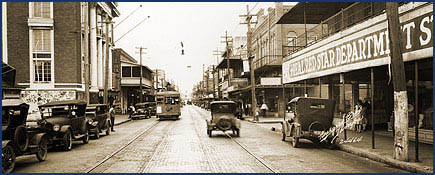

"A World Ahead of The Competition."Transworld Futures specializes in futures and options trading. We are fully registered and licensed as an Introducing Broker with the CFTC, Commodity Futures Trading Commission (http://www.cftc.gov), the federal regulatory agency of futures and options. We also are a member of the NFA, National Futures Association (http://www.nfa.futures.org/), a self-regulatory agency. Ironbeam Inc.(http://www.ironbeam.com) is our clearing firm, and your funds are securely deposited with BMO Harris Bank, N.A., Chicago, Illinois. Our goal is to provide you with professional and friendly service along with timely and accurate information to assist in your investment decisions. We believe experience of our staff, the character of our personnel, and the level of service we provide, make us the right investment group for you.  Transworld Futures was founded with the goal of providing the personalized service and level of expertise not found elsewhere in the commodity futures industry. Our team of qualified and experienced brokers will take the time and make the effort to assist you to succeed in your commodity trading plans.  Transworld Futures is headquartered in Valparaiso, IN - a suburb of Chicago, IL. Chicago is known as the "hub of commodity trading" being home to the Chicago Mercantile Exchange and Chicago Board of Trade.

Contact Transworld Futures Today!

|

Trading PlatformsAll Trading Platforms Firetip Trading Platform IB Web Trader Ninja Trader Sierra Chart TT X Trader TT X Trader ProOur ServicesAccount Types Free Papertrading |