|

The U.S. cotton industry generates more than 400,000 jobs among the

various sectors from farm to textile mill and accounts for more than

$40 billion in products and services annually. Cotton is produced in

17 southern States from Virginia to California. Major concentrations

include areas of:

- the Texas High and Rolling Plains;

- the Mississippi, Arkansas, and Louisiana Delta;

- California's San Joaquin Valley;

- Central Arizona; and

- Southern Georgia.

|

The U.S. cotton industry generates more than 400,000 jobs among the

various sectors from farm to textile mill and accounts for more than

$40 billion in products and services annually. Cotton is produced in

17 southern States from Virginia to California. Major concentrations

include areas of:

- the Texas High and Rolling Plains;

- the Mississippi, Arkansas, and Louisiana Delta;

- California's San Joaquin Valley;

- Central Arizona; and

- Southern Georgia.

U.S. cotton is grown as an annual from seed planted each year,

although cotton can be grown as a perennial in tropical climates.

Given the vast differences across the U.S. production area, the

cotton growing season varies dramatically, as typical planting

occurs between March and June and usual harvesting occurs between

August and December.

The predominant type of cotton grown in the United States is

American Upland (Gossypium hirsutum). The upland type, which usually

has a staple length of 1 to 1 1/4 inches, accounts for about 97

percent of the annual U.S. cotton crop. Upland cotton is grown

throughout the U.S. Cotton Belt as well as in most major

cotton-producing countries. The balance of U.S.-grown cotton is

American Pima or extra-long staple (ELS) (Gossypium barbadense). ELS

cotton, which has a staple length of 1 1/2 inches or longer, is

produced predominantly in California, Arizona, New Mexico, and

southwest Texas, where it is particularly well adapted to the arid

environmental conditions. The markets for ELS cotton are mainly

high-value products such as sewing thread and expensive apparel.

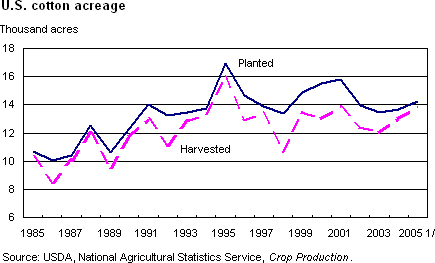

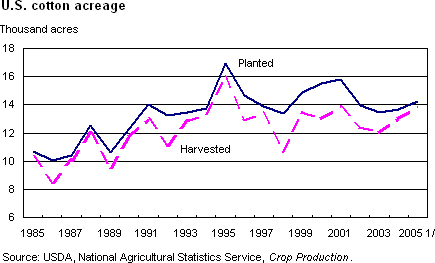

Cotton acreage in the United States rose slightly during the 1990s

from the previous two decades. In the 1970s and 1980s, area planted

to cotton averaged about 12 million acres. Area rose to about 14

million acres in the 1990s, and has averaged slightly higher since

then. Most the growth in area has been in the Southeast, in part

reflecting the cost-reducing impact of boll-weevil eradication.

According to the Census of

Agriculture, U.S. cotton farms numbered 24,805 in 2002, down from

33,640 in 1997. While the number has fallen, cotton acreage per farm

has risen. As a result, the number of large cotton farms (over 1,000

acres) has continued to increase while the number of small cotton

farms (under 100 acres) declines.

Like area, cotton

production in the United States during the 1990s rose above the previous

two decades, paralleling advances in technology (seed varieties,

fertilizers, pesticides, and machinery) and production practices

(reduced tillage, irrigation, crop rotations, and pest management

systems). In recent years, the impact of these changes has been

particularly evident, with yields reaching new highs.

Consumption of

cotton by U.S. textile mills also rose during the 1990s, but peaked in

1997. Since then, U.S. mill use of cotton has plummeted, dropping about

50 percent by 2005. While the end of the Multifibre Arrangement’s (MFA)

quotas in 2005 was a factor in this decline, much of the decline in U.S.

textile production occurred before then. U.S. consumer demand for cotton

has continued to grow, but imported clothing now accounts for most

purchases by U.S. consumers.

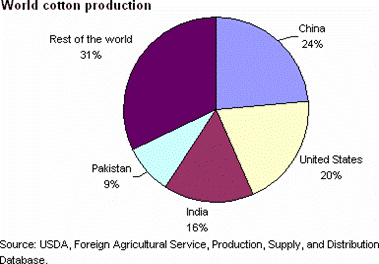

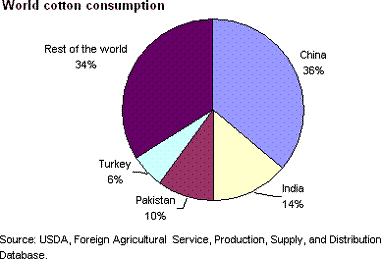

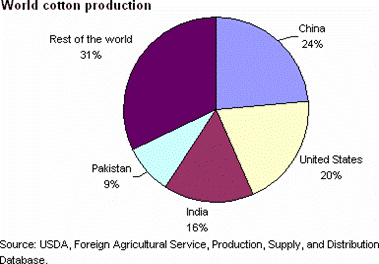

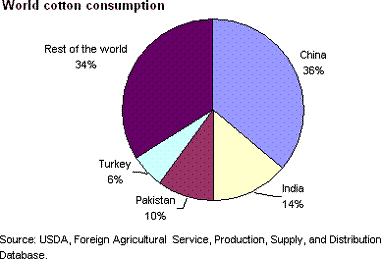

The world's four

largest cotton-producing countries are China, the United States, India,

and Pakistan, which together account for nearly 70 percent of world

production. Other major producers include Uzbekistan, Brazil, and

Turkey. Turkey is the fourth largest consumer of cotton in the world

behind China, India, and Pakistan (bumping the United States to fifth

place among consuming nations). Like Turkey, Brazil is also a major

cotton-consuming country, but is increasingly exporting cotton to the

world market, while Turkey’s imports have grown. While cotton is

generally a Northern Hemisphere crop, about 10 percent of the world's

output comes from south of the equator (primarily Brazil and Australia)

and is harvested during the Northern Hemisphere's spring.

Trade is

particularly important for cotton. More than 30 percent of the world's

consumption of cotton fiber crosses international borders before

processing, a larger share than for wheat, corn, soybeans, or rice.

Through trade in yarn, fabric, and clothing, much of the world's cotton

again crosses international borders at least once more before reaching

the final consumer.

The cotton industry

continues to face many of the supply and demand concerns confronting

other field crops. However, since cotton is used primarily in

manufactured products, the industry faces additional challenges

associated with the economic well-being of downstream manufacturing

industries.

Cotton Commodity

Information:

Minimum Price

Movement for Cotton Futures

1/100 of a cent

(one "point") per pound below 95 cents per pound. 5/100 of a cent (or

five "points") per pound at prices of 95 cents per pound or higher.

Spreads may always trade and be quoted in one point increments.(point

value of $5/contract)

Daily Price

Limit for Cotton Futures

3 cents above or

below previous day's settlement price. However, if any contract months

settles at or above $1.10 per pound, all contract months will trade with

4 cent price limits. Should no month settle at or above $1.10 per pound,

price limits stay (or revert) to 3 cents/lb. Spot month - no limit on or

after first notice day.

Last Trading Day

for Cotton Futures

Seventeen business

days from end of spot month.

First Notice Day

for Cotton Futures

Five business days

before the first notice day of the spot contract month.

Last Notice Day

for Cotton Futures

Twelve business

days from end of spot month.

Contract

Symbol for Cotton Futures

CT

Cotton Futures Contract Size

50,000 pounds net weight

Cotton Futures Contract Months

March, May, July,

October, December (Current month plus one or more of the next 23

succeeding months)

Contract Settlement

Physical

Delivery

Cotton Futures Trading Hours

10:30 am to 2:15

pm; pre-open commences at 10:20 a.m.; closing period commences at 2:14

pm (electronic trading hours: 1:30 a.m. - 3:15 p.m. ET)

Price Quotation

Cents and hundredths of a cent per

pound

|