|

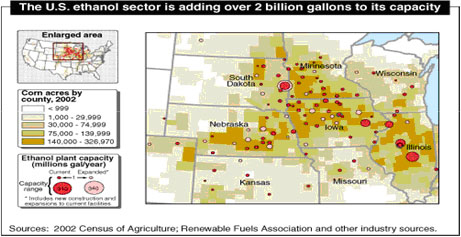

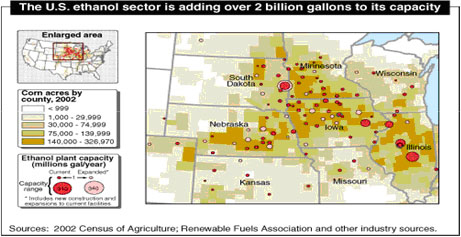

The year 2005 was marked by a flurry of

construction activity in the Nation’s ethanol industry, as ground was

broken on dozens of new plants throughout the U.S. Corn Belt and plans

were drawn for even more facilities. As of February 2006, the annual

capacity of the U.S. ethanol sector stood at 4.4 billion gallons, and

plants under construction or expansion are likely to add another 2.1

billion gallons to this number (map). If this trend and the existing and

anticipated policy incentives in support of ethanol continue, U.S.

ethanol production could reach 7 billion gallons in 2010, 3.3 billion

more than the amount produced in 2005.

The

tremendous expansion of the ethanol sector raises a key question: Where

will ethanol producers get the corn needed to increase their output?

With a corn-to-ethanol conversion rate of 2.7 gallons per bushel (a rate

that many state-of-the-art facilities are already surpassing), the U.S.

ethanol sector will need 2.6 billion bushels per year by 2010—1.2

billion bushels more than it consumed in 2005. That’s a lot of corn, and

how the market adapts to this increased demand is likely to be one of

the major developments of the early 21st century in U.S. agriculture.

The most recent USDA Baseline Projections suggest that much of the

additional corn needed for ethanol production will be diverted from

exports. However, if the United States successfully develops cellulosic

biomass (wood fibers and crop residue) as an economical alternative

feedstock for ethanol production, corn would become one of many crops

and plant-based materials used to produce ethanol.

#That

70s Energy Scene

The factors behind ethanol’s resurgence

are eerily reminiscent of the 1970s and early 1980s, when interest in

ethanol rebounded after a long period of dormancy. First, the price of

crude oil has risen to its highest real level in over 20 years,

averaging more than $50 per barrel in 2005. Long-term projections from

the U.S. Department of Energy’s Energy Information Administration (EIA)

suggest that the price of imported low-sulfur light crude oil will

exceed $46 per barrel (in 2004 prices) throughout the period 2006-30 and

will approach $57 per barrel toward the end of this period. It is

important to remember, however, that as the price of oil dropped during

the first half of the 1980s, so, too, did ethanol’s profitability.

Second, many refineries are replacing

methyl tertiary butyl ether (MTBE) with ethanol as an ingredient in

gasoline. Oxygenates such as MTBE and ethanol help gasoline to burn more

thoroughly, thereby reducing tailpipe emissions, and were mandated in

several areas to meet clean air requirements. But many State governments

have recently banned or restricted the use of MTBE after the chemical

was detected in ground and surface water at numerous sites across the

country. In the 1970s and 1980s, a similar phaseout ended the use of

lead as a gasoline additive in the United States. Both ethanol and lead

raise the octane level of gasoline, so the lead phaseout also fostered

greater use of ethanol.

Third, the

Energy Policy Act of 2005 specifies a new Renewable Fuel Standard (RFS)

that will ensure that gasoline marketed in the United States contains a

specific minimum amount of renewable fuel. Between 2006 and 2012, the

RFS is slated to rise from 4.0 to 7.5 billion gallons per year.

Assessments of the existing and likely future capacity of the U.S.

ethanol industry indicate that the RFS will easily be achieved. The RFS

joins a long list of incentives that the State and Federal governments

have directed toward ethanol since the 1970s. One of the most important

of these incentives is the Federal tax credit, initiated in 1978, to

refiners and marketers of gasoline containing ethanol. The credit, which

may be applied either to the Federal sales tax on the fuel or to the

corporate income tax of the refiner or marketer, currently equals 51

cents per gallon of ethanol used.

Where Will the Corn Come From?

Large corn stocks will enable U.S.

ethanol production to increase initially without requiring much

additional adjustment in the corn market. The U.S. ended the 2004/05

marketing year (MY—September 2004-August 2005) with stocks of 2.1

billion bushels—enough to produce 5.7 billion gallons of ethanol. As

long as corn is the primary feedstock for ethanol in the U.S., however,

sustained increases in ethanol production will eventually require

adjustments in the corn market.

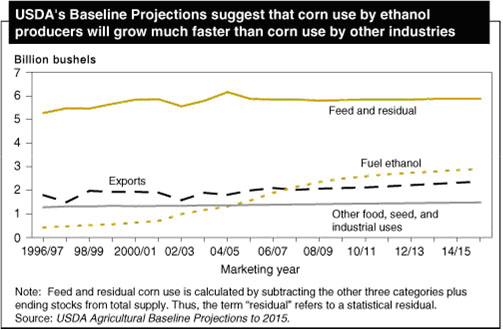

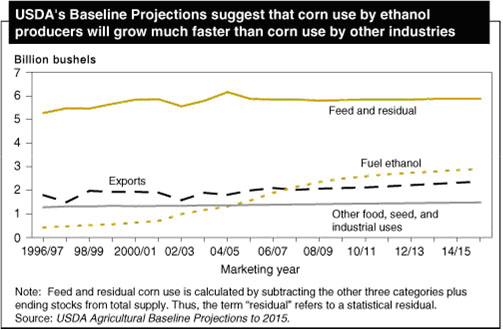

One possibility is that ethanol producers

will secure the additional corn they need by competing with other buyers

in the marketplace and bidding up the price of corn. According to the

USDA Agricultural Baseline Projections (released in February 2006), the

share of ethanol in total corn use will rise from 12 percent in 2004/05

to 23 percent in 2014/15. A comparison of the 2006 Baseline with the

2005 Baseline suggests that much of the increased use by ethanol

producers will be diverted from potential exports; the 2006 Baseline

projects higher use for ethanol and lower exports than the 2005

Baseline.

If demand for ethanol reduces the

availability of U.S. corn for export, one might ask how this will alter

the geographical composition of U.S. exports. The 2006 Baseline suggests

that among the major foreign buyers of U.S. corn, Japan and Taiwan are

likely to be the least responsive to a rise in corn prices, while

Canada, Egypt, and the Central American and Caribbean region are likely

to be the most responsive. Japan and Taiwan both have relatively high

per capita incomes and limited corn production. In contrast, Canada,

another high-income country, has substantial levels of corn production

and could respond to higher prices with increased output of corn, wheat,

and other feed grains. Per capita income in Egypt, Central America, and

the Caribbean is relatively low, and higher prices may drive these

countries to cut back in corn use, increase domestic corn production, or

seek out substitutes. Egypt already produces a sizable amount of corn.

Slower growth of U.S. corn exports would

create new opportunities for corn producers in other parts of the world,

including Argentina, Brazil, and China. Another country to watch is

Mexico, where irrigated lands have accounted for about half of the

increase in domestic corn production since the late 1980s. Much of this

increase has taken place in the State of Sinaloa, where farmers are

applying advanced agricultural techniques to obtain yields comparable to

those in the United States. Sinaloa, however, is relatively distant from

corn-deficit areas in Mexico, and many of these producers have counted

on marketing subsidies to offset some of the transportation costs.

Increased demand for corn by U.S. ethanol producers might push prices

high enough that these transportation costs are more easily surmounted.

Farmers May Increase Corn Supply

The growing corn demand of ethanol

producers could also be satisfied through higher corn output. Rising

productivity is likely to assure some increase in U.S. corn production

in the years to come, even if the amount of farmland devoted to corn

remains constant. Over the past decade (1996-2005), U.S. corn yields

averaged 138 bushels per acre, compared with 115 bushels during the

previous decade. The United States also could increase corn production

by devoting more land to the commodity. Such an effort would probably

draw upon lands less suited to corn production. Much of these lands

would probably be diverted from soybean production.

Growing corn more intensively is yet

another approach. For instance, some producers who currently pursue a

corn-soybean rotation (planting corn one year and soybeans the next)

might shift to a corn-corn-soybean rotation (planting corn 2 years in a

row and then planting soybeans in the third). Continuous production of

corn (planting corn every year on the same plot of land) is another

possibility. Interestingly, one of the key factors boosting ethanol

demand—high oil prices—also makes intensive corn production less

attractive because more fertilizer would be needed.

One way to get more ethanol feedstock out

of existing levels of corn production is to use the stalk, leaves, and

cobs left over after harvest—materials that are formally known as

stover. An acre of corn will yield roughly 5,500 dry pounds of stover,

enough to produce about 180 gallons of ethanol. In the United States,

corn stover is typically left in the field following harvest to minimize

erosion and to contribute organic matter to the soil, so removing some

of the stover at harvest might adversely affect the long-term viability

of the soil.

Market Adjustments Extend to Ethanol

Co-Products and Beyond

As ethanol production increases, the

supply of ethanol co-products will also increase. Both the dry-milling

and wet-milling methods of producing ethanol generate a variety of

economically valuable co-products, the most prominent of which is

perhaps distiller’s dried grains with solubles (DDGS), which can be used

as a feed ingredient for livestock. Each 56-pound bushel of corn used in

dry mill ethanol production generates about 17.4 pounds of DDGS. In the

United States, cattle (both dairy and beef) have so far been the primary

users of DDGS as livestock feed, but larger quantities of DDGS are

making their way into the feed rations of hogs and poultry. Use of

distiller’s grains in animal production lowers the use of corn and

protein supplements.

The marketing of ethanol co-products is

just one way in which ethanol producers are making their operations more

profitable. Another way is to save energy by locating ethanol plants in

close proximity to dairy or livestock production. Specifically, a dairy

or livestock producer is able to lower the transport costs associated

with feed acquisition by establishing a nearby facility to manufacture

ethanol and distiller’s grains. The latter may be quickly transported to

feed nearby livestock without needing to be dried, and the manure

generated by the livestock can be used to produce heat or electricity

for the ethanol plant, but this entails a sizable capital cost.

Closer integration of ethanol production

with other agri-industrial activities is likely to displace some

traditional marketing and distribution channels for corn. Indeed, the

services of some grain elevators may no longer be needed in some areas

if local corn supplies are used in their entirety for ethanol

production. The transportation sector may be the site of several

noteworthy adjustments, as the profitability of the expanded ethanol

sector will depend on economical methods of handling the growing supply

of ethanol and its co-products, as well as the feedstock necessary to

produce them. Some large-scale ethanol plants may find it cost effective

to receive corn deliveries by rail on specially constructed trunk lines,

while others may rely on truck, barge, or existing rail lines, depending

on the location of the facility. The transportation of ethanol requires

special attention. Ethanol is usually not moved across large distances

by pipeline because the product has the ability to absorb the water and

impurities commonly found in pipelines. Instead, the product is

customarily shipped in tanks by train, truck, or barge, and then mixed

directly with gasoline in the tanker trucks that deliver fuel to gas

stations.

New Feedstocks Are the Wild Card

The search for ethanol feedstocks will

not stop at the edge of the corn field. While corn is currently the

primary feedstock for U.S. ethanol production, many other agricultural

commodities and plant-generated materials can be used to produce the

fuel. For example, ethanol derived from sugar cane satisfies roughly

half of Brazil’s annual demand for motor vehicle fuel, and sorghum is

the feedstock for about 3 percent of U.S. ethanol production.

The U.S. and many other countries are

very interested in cellulosic biomass as a potential feedstock for

ethanol. Cellulosic biomass refers to a wide variety of plentiful

materials obtained from plants—including certain forest-related

resources (mill residues, precommercial thinnings, slash, and brush),

many types of solid wood waste materials, and certain agricultural

wastes (including corn stover)—as well as plants that are specifically

grown as fuel for generating electricity. A report prepared for the U.S.

Department of Energy and USDA in 2005 suggests that, by the middle of

the 21st century, the United States should be able to produce 1.3

billion dry tons of biomass feedstock per year—enough to displace at

least 30 percent of its current petroleum consumption.

Harnessing cellulosic biomass to produce

ethanol will require the development of economically viable technologies

that can break the cellulose into the sugars that are distilled to

produce ethanol. No one knows for sure how long it will take to develop

these technologies, although the more optimistic predictions are in the

neighborhood of 5-10 years. To expedite the achievement of this goal,

the Energy Policy Act of 2005 directs incentives specifically toward the

use of cellulosic biomass as a feedstock for renewable fuel. For the

purpose of meeting the Renewable Fuel Standard, 1 gallon of cellulosic

biomass ethanol is treated as 2.5 gallons of renewable fuel through the

end of 2012. The Act also provides for research, development, and

demonstration projects concerning cellulosic biomass, and it mandates

that at least 250 million gallons of renewable fuel be produced per year

using cellulosic biomass, beginning in 2013. Until cellulosic biomass is

successfully commercialized, however, corn will almost certainly remain

the primary feedstock for U.S. ethanol production.

Ethanol Futures

Information

Ethanol Futures

Contract Size

29,000 U.S. gallons

(approximately one rail car)

Deliverable

Grades for an Ethanol

Futures Contract

Denatured Fuel

Ethanol as specified in The American Society for Testing and Materials

standard D4806 for Denatured Fuel Ethanol for Blending with Gasolines

for Use as Automotive Spark-Ignition Engine Fuel plus California

standards.

Tick Size

One tenth of one

cent ($0.001) per gallon ($29 per contract)

Price Quote

Dollars and

cents/gallon

Ethanol Futures

Contract Months

All calendar months

Ethanol Futures

Last Trading Day

The 3rd business day

of the delivery month.

Last Delivery Day

for Ethanol Futures

The second business

day following the last trading day of the delivery month.

Ethanol Futures

Trading Hours

Open Auction: 9:30

a.m. - 1:15 p.m. Chicago Time

Electronic Platform: 6:36 p.m. - 6:00 a.m. and 9:30 a.m. to 1:15 p.m.

Chicago Time

Note: Expiring contract closes at 12:00 noon on Last Trading Day.

Ethanol Futures

Ticker Symbols

AC for Open Auction

ZE for Electronic

Ethanol Futures

Daily Price Limit

Thirty cents ($0.30)

per gallon ($8,700 per contract) above or below the previous day's

settlement price. No limit in the spot month ( limits are lifted

beginning on First Position Day

|